Save and Invest

AFPFC MPC saving accounts offer a secure and effective way to reach your financial goals. With attractive interest rates, flexible deposit options, and exclusive member benefits, our accounts are built to help you make the most of your money. Start your journey to a brighter financial future with AFPFC MPC today!

Capital Contribution Account

Enjoy one of the highest interest on Share Capital as an AFPFC MPC Kamay-ari! This is distributed every July and December every year.

.png)

Special Savings Account

Unlock 6% Interest per annum with AFPFC's Special Savings Account! Deposit for as low as P10,000.00 with no maximum limit.

.png)

Regular Savings Account

Our Regular Savings Account offers you a 5% interest on your savings with a hassle-free setup for automatic deduction.

.png)

Regular Savings Account 2

Our Regular Savings Account offers no minimum deposit placement and earns 1.5% interest per annum.

Apply for a Loan

.png)

Salary Loan

Active personnel and employees of AFP, Bucor, BFP, PVAO, and AFPMBAI are eligible to avail Salary Loan subject to allowable limit and set of loan of requirements.

.png)

Pension Loan

Retired AFP personnel and beneficiaries receiving AFP pension may apply for this type of loan ranging from 12 months to 60 months term.

Back-to-Back Loan

The Back-to-Back Loan is available to AFPFC MPC members with savings deposit used as a collateral to avail this type of loan.

.png)

.png)

Lumpsum Loan

The Lumpsum loan is designed for active AFP personnel who are retiring from service. He/she can borrow up to 40% of their lumpsum amount, which is payable over 5 months at an interest rate of 1% per month.

Back-to-Back Flexi Loan

Get ready access to funds for your unique needs using up to 100% of your savings account as collateral. Enjoy shortened 3 to 12 months loan payment terms!

Limited time offer until December 31, 2025 only.

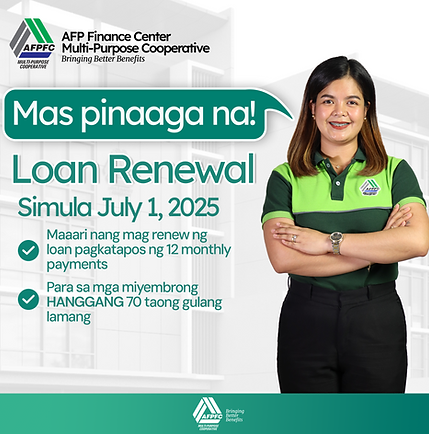

Mas Pinaaga na ang Loan Renewal!

Ang mga miyembrong may edad na hanggang 70 taong gulang ay maaari nang magrenew matapos ng 12 monthly payments sa kanilang loans.

---24x24inches%202.png)